Why should you invest in physical Gold?

Explore our concise guide to discover the key reasons to invest in gold bullion bars and coins. Gold offers a range of unique benefits as an investment. Understanding these advantages will help you determine whether physical gold is the right asset for your portfolio and if investing in it aligns with your financial goals.

1. Safe haven

Gold is widely regarded as a safe haven and an ideal long-term investment, primarily for preserving wealth. Here are the key reasons why:

Gold tends to consistently maintain its value over time, especially during periods of political and economic uncertainty. For example, in 2017 and 2018, gold proved to be an effective “hedge against fear.” Political instability often signals government weakness, and since governments back their issued currencies, a loss of confidence in government usually foretells currency depreciation. For this reason, gold is considered a form of financial insurance.

Additionally, gold protects purchasing power during times of high inflation. As a precious metal with a finite supply, gold holds intrinsic value. In contrast, fiat currencies tend to lose value over time when adjusted for inflation. Experts commonly agree that gold provides a reliable hedge against the weakening of the US dollar. Historically, when fiat currencies become destabilized, gold prices rise accordingly.Ultimately, it is not the nominal price of gold that matters, but its ability to preserve what you can buy with it.

2. Portfolio diversification

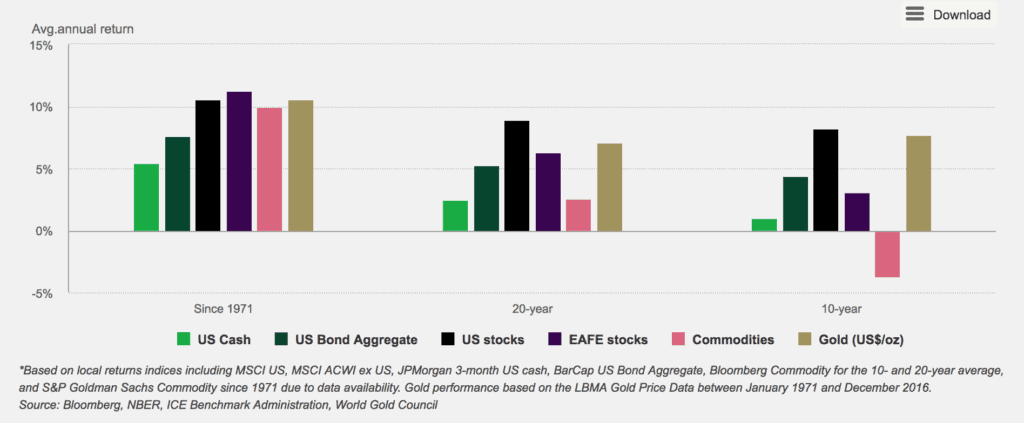

Gold Returns: Historical data from the World Gold Council

Experts agree that allocating a portion of your investment portfolio to gold is an effective diversification strategy. Just as property was a reliable asset before the 2007 financial crisis, gold remains a strong asset to hold through various market cycles. Diversifying your investments across different asset classes is a prudent way to reduce overall risk and hedge against market volatility. When stocks underperform, gold prices often trend upward, providing a valuable balance.

A recommended allocation of 5-10% of your portfolio in gold is an excellent starting point. While gold does not generate income like dividends or interest, its primary role is as a store of value. Crucially, gold’s price movements are typically uncorrelated with other financial assets, which helps stabilize your portfolio.

Historical data from the World Gold Council shows that gold has consistently delivered strong returns over the long term, often outperforming other investments during turbulent times. Contrary to common misconceptions, owning gold is not limited to the ultra-wealthy. In countries like Russia, Austria, Germany, and Turkey—many of which have faced economic instability—holding physical gold bars and coins is a widespread practice. Similarly, in India, gold has long been regarded as a safe haven and a trusted means to protect and preserve wealth. In summary, incorporating gold into your portfolio offers a time-tested way to diversify, hedge risk, and safeguard your financial future.

3. Tangible asset

Although gold is no longer used as a day-to-day currency, its historical significance as a monetary standard continues to make it highly attractive. For over 3,000 years, gold has remained a reliable store of value due to several key characteristics:

- Portable: Thanks to its high density and value, just a few grams of gold can represent a substantial amount of wealth, while remaining easy to carry.

- Divisible: The wide range of gold coins and bullion available allows it to be easily divided into smaller, manageable units.

- Fungible: Gold is universally accepted and can be converted into virtually any local currency around the world.

- Durable: Gold’s physical properties ensure it can last for decades, or even centuries, without degrading.

4. Increasing demand

Gold is a relatively rare commodity with diverse applications that span across various sectors. Its primary demand comes from the jewellery industry, with India and China representing the largest markets by volume. Beyond its ornamental value, gold is highly regarded as an investment asset by central banks and private investors alike. Within investment portfolios, gold serves as a hedge against inflation, provides protection for purchasing power, and helps reduce overall portfolio volatility during periods of economic turmoil.

Apart from jewellery and investment, gold is indispensable in the technology sector, particularly as a reliable conductor in electronic components like motherboards. Recent advances in nanotechnology are further expanding gold’s role into emerging fields such as medicine, engineering, and environmental management. Its unique properties are being harnessed to facilitate drug delivery, develop advanced catalysts for purifying water and air, and create innovative solutions across multiple industries. These expanding applications highlight gold’s versatility and underscore its promising prospects for the future.