Gold Bars vs Gold Coins: Which is the better investment?

Are you new to investing in gold and wondering whether to start with gold bars or coins? This easy-to-follow guide breaks down the advantages and drawbacks of both options, helping you make the best decision for your investment goals.

Why buy Gold Bars?

Gold bars are typically produced in 24 carats (99.99% pure gold) and are accompanied by an assay certificate, which guarantees their weight, purity, and compliance with Good Delivery Standards. Newly minted gold bars, starting from 100 grams, are usually sold in sealed packaging to protect the bar’s quality.

Investors with larger budgets often choose gold bars as they carry lower premiums, equating to the lowest price per gram. For this reason, gold bars are regarded as one of the most cost-effective ways to invest in gold.

Multiple sizes available

Gold bars are available in a broad range of sizes, from as little as 1 gram to as much as 1 kilogram, allowing buyers to select the size that best fits their budget and investment objectives.

Smaller bars, such as 20 grams or 1 ounce, are often chosen by those who wish to make regular purchases of physical gold or are just beginning their investment journey. In contrast, larger bars—particularly the 1-kilogram size—are favored by those interested in making significant, single investments. This variety ensures that whether you are new to investing or an experienced buyer, there is a gold bar size well-suited to your financial plans and strategies.

Standard for Gold investment

A gold bar is the standard format for gold investment. It is exchangeable worldwide to any bullion dealer as long as it has been manufactured by an LBMA approved refiner.

Ideal for long-term investment

Gold bars are an excellent choice if you plan to hold physical gold for the long term without selling portions over time. They typically have a lower cost per gram compared to gold coins due to lower premiums. This makes them a more cost-effective option for investors focused on maximizing their gold holdings.

Cheaper premium compared to spot pirce

Gold bars generally cost less to produce than gold bullion coins, resulting in a lower premium over the spot price. Additionally, the larger the gold bar, the smaller the premium you pay. For example, purchasing a single 1kg gold bar typically incurs lower manufacturing costs and a smaller overall premium than buying ten separate 100g gold bars.

Choosing a 1kg bar instead of ten 100g bars could save you around 1%. However, while this approach is more cost-effective, it also reduces flexibility in your portfolio. You cannot sell a fraction of a 1kg gold bar, which may limit your ability to access part of your investment when needed. Furthermore, smaller local dealers are generally less likely to buy a large gold bar compared to more commonly traded sizes, such as multiple 1oz bars.

Flexibility

While larger gold bars often come with lower premiums, they are not always the most practical choice. Smaller bars offer greater flexibility, making it easier to sell portions of your investment in the future. For most UK bullion investors, 100g and 1oz gold bars provide an optimal balance between value and flexibility. Smaller bars, such as the 50g and 20g, also offer a convenient size with relatively low premiums. For larger investors seeking maximum value for their budget, 1kg gold bars remain the most cost-effective option.

Disadvantage of Gold Bars

While large gold bars typically offer the best value per gram at the time of purchase, they may not be the most practical choice for resale in the future. Individual investors often adjust the gold allocation in their portfolios over time for example, reducing a gold position from 20% to 10% to diversify into stocks. If an investor has purchased a 1kg gold bar, this presents two main challenges:

- To decrease their gold holdings, the investor would need to sell the entire 1kg bar and potentially repurchase a smaller bar, rather than selling just a portion of their gold.

- If the price of gold has increased since the original purchase, selling and buying back at a higher price may reduce the overall profitability of the initial investment.

Therefore, large gold bars can limit flexibility and increase exposure to market risks, since your whole investment depends on the price movements of a single, large asset. You are also limited to the price at which you bought the bar, rather than taking advantage of multiple price points.

An alternative is to invest in several smaller bars, which allows you to sell portions of your gold holdings as needed. However, smaller bars generally come with higher premiums and lower gold content per gram compared to large bars. Another option is to purchase gold bullion coins; these often have lower premiums than small bars and offer greater flexibility, making them a popular choice among both new and experienced investors.

Why buy Gold Coins?

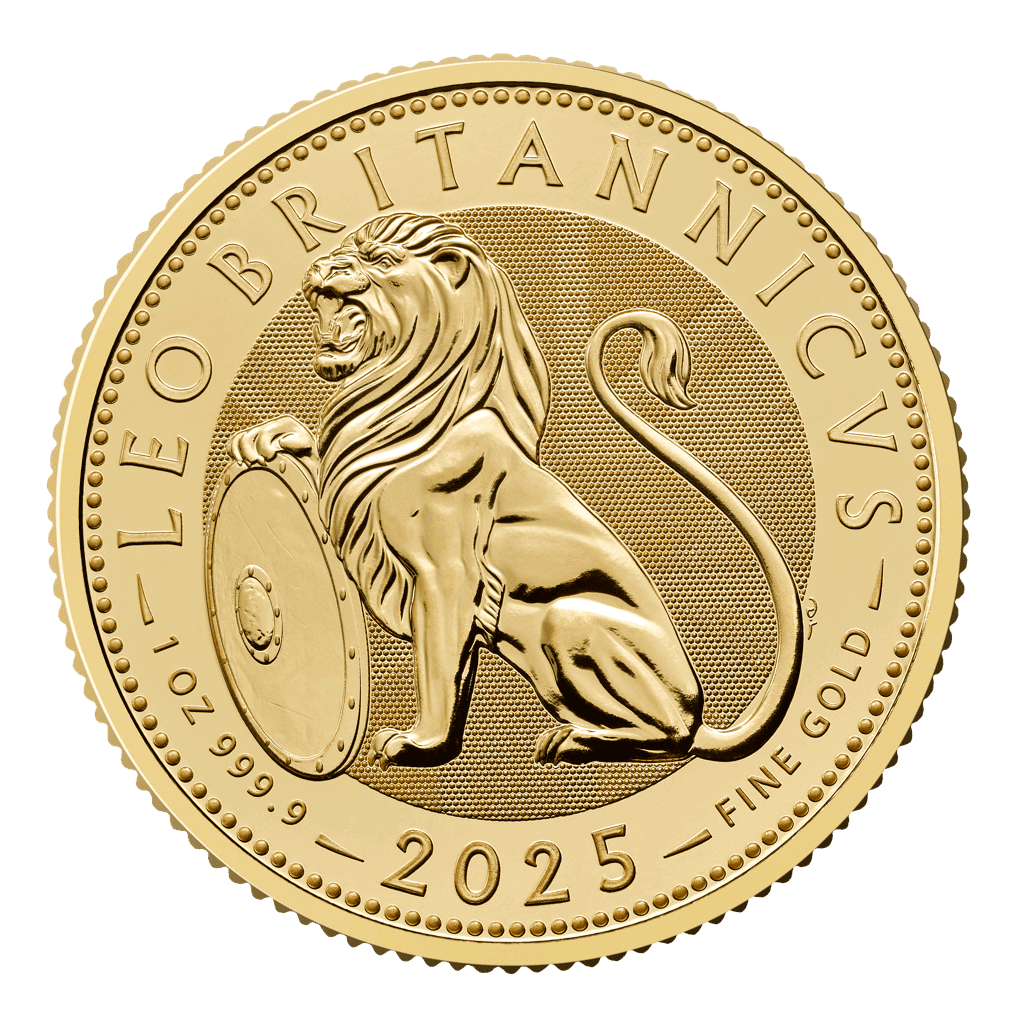

Gold coins offer an accessible and reliable way to invest in physical gold. Today, leading government mints worldwide produce gold bullion coins specifically for investment purposes. Among the most popular are the British Britannia, the South African Krugerrand, the Canadian Maple Leaf, the American Eagle and the Vienna Philharmonic.

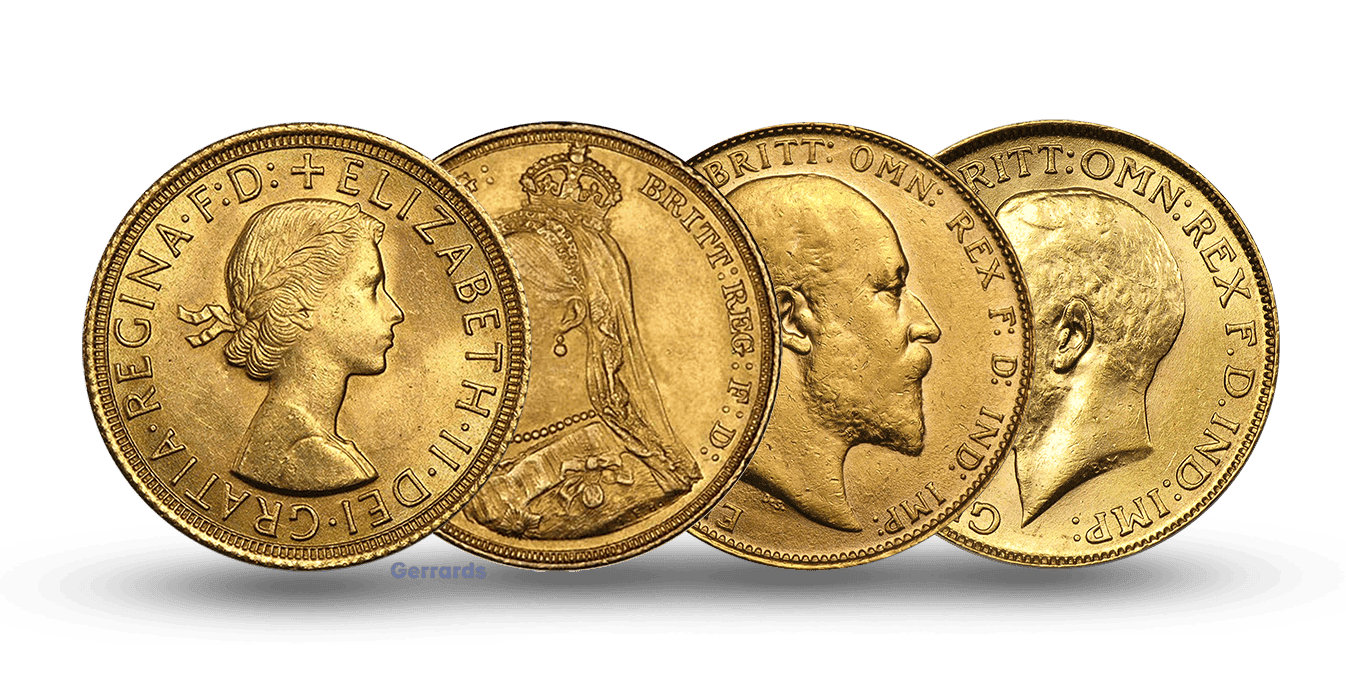

These coins are typically struck in either 22-carat (91.67%) or 24-carat (99.99%) gold. The standard weight for investment-grade bullion coins is 1 troy ounce (31.1035 grams) of pure gold. Each coin features a distinctive design and the year of issue on the obverse, while the reverse usually displays the coin’s weight and gold purity. This combination of recognized purity, standard weight, and government backing makes gold coins a trusted choice for investors seeking tangible assets.

Wide range of varieties available

Gold bullion coins offer a wide variety of choices for investors. They are available in multiple sizes, including 1oz, 1/2oz, 1/4oz, and 1/10oz, allowing for flexibility to suit different investment needs. Full and half gold sovereigns, each containing 7.32g of gold, remain especially popular and are well-suited for trading due to their convenient size and strong liquidity. Among the most sought-after options is the South African Krugerrand, widely regarded as a safe choice for first-time gold investors. The 1oz gold Krugerrand, in particular, is notable for offering some of the lowest premiums, making it a cost-effective investment.

More flexibility

Gold bullion coins offer more flexibility than large gold bars, which cannot be easily divided or sold in parts. Coins allow you to split your investment into smaller, manageable portions, making it possible to buy or sell incrementally as needed. This means you do not have to liquidate your entire holding at once, unlike with a single large gold bar. Additionally, coins let you reduce market risk because you are not forced to sell all your gold at one price point; instead, you can sell coins gradually in response to favorable market conditions. Gold sovereigns are especially well suited for this strategy. They are among the least expensive gold coins and are recognized for their ease of sale. Due to their compact size—each coin weighs 7.32 grams—you can easily divide your investment into smaller units, providing additional flexibility and convenience.

Highly liquid

Gold coins offer exceptional liquidity, making them an ideal choice for investors worried about quick access to cash. Their universal recognition ensures they are widely accepted and easy to resell across global markets. Because gold coins are available in smaller denominations, you can efficiently convert part of your holdings to cash as needed, without selling all your assets. In the bullion market, one-ounce gold coins are among the most actively traded products, further supporting their popularity and liquidity.

Capital Gains Tax benefits

If you are a UK resident and concerned about Capital Gains Tax (CGT) liabilities on your investments, British gold coins present an exceptionally tax-efficient choice. Gold coins such as the Britannia and Sovereign are classified as legal tender in the UK. These coins, produced by The Royal Mint, are completely exempt from Capital Gains Tax, regardless of the size or value of your profits. This allows you to realize unlimited gains when selling without any CGT liability.

Collectible items

Collectible gold coins offer a unique appeal beyond their metal content, as certain coins—like the Gold Sovereign—often carry higher premiums when they become especially sought after by collectors. These premiums can significantly increase the coins’ resale value; for instance, during the 1960s, trading Gold Sovereigns attracted premiums as high as 40%. When demand spikes for specific issues or mint years, sellers may obtain a considerably better price than the coin’s intrinsic gold value.

Beyond the financial aspects, each gold coin is rich in history, and its design often commemorates significant events or figures. This historical connection turns them into interesting collectibles apart from their investment potential. For example, the 2012 Gold Sovereign marked the Diamond Jubilee, celebrating 60 years of Queen Elizabeth II’s reign. Such coins frequently reflect noteworthy moments from their country of origin, making them prized not just as investments but also as pieces of cultural heritage.

Disadvantage of Gold Coins

Gold coins usually carry higher premiums than gold bars due to design and minting costs, meaning you get less gold for your money. Buying in bulk can reduce these premiums and lower the price per gram.

There’s a key difference between bullion and collectible coins: bullion coins (especially those minted after the 1930s) have lower premiums and their value is mostly based on gold content, making them more cost-effective for investment. Collectible, proof, or historic coins often have much higher premiums due to rarity and numismatic value.

Summary

The optimal way to buy gold ultimately depends on your individual circumstances, preferences, and financial goals. Key factors to consider include premiums, flexibility, and—if you’re investing significant sums—the impact of Capital Gains Tax.

For first-time investors, gold coins provide an excellent introduction to physical gold. However, diversifying your portfolio with both bars and coins is recommended. While buying larger bars may offer lower premiums, it can reduce portfolio flexibility. Gold comes in a variety of forms and sizes, allowing you to break up your investment into smaller pieces—such as coins and small bars—which makes it easier to sell or transport portions of your holdings as needed.

Remember, there is no definitive right or wrong choice between buying gold bars or coins. The decision is a matter of personal preference and how much risk you are comfortable taking. After conducting your own research and deciding on the type of gold bullion that best suits your needs, we hope you’ll consider Gerrards Bullion for your investment.

Gerrards Bullion offers a wide selection of gold bullion bars and coins for sale. Browse our online store and place your order using our secure payment system. If you would rather order by phone or have any questions, please call us – 0207 242 7521.